The users can view the Challan details available with the department through IT Portal.

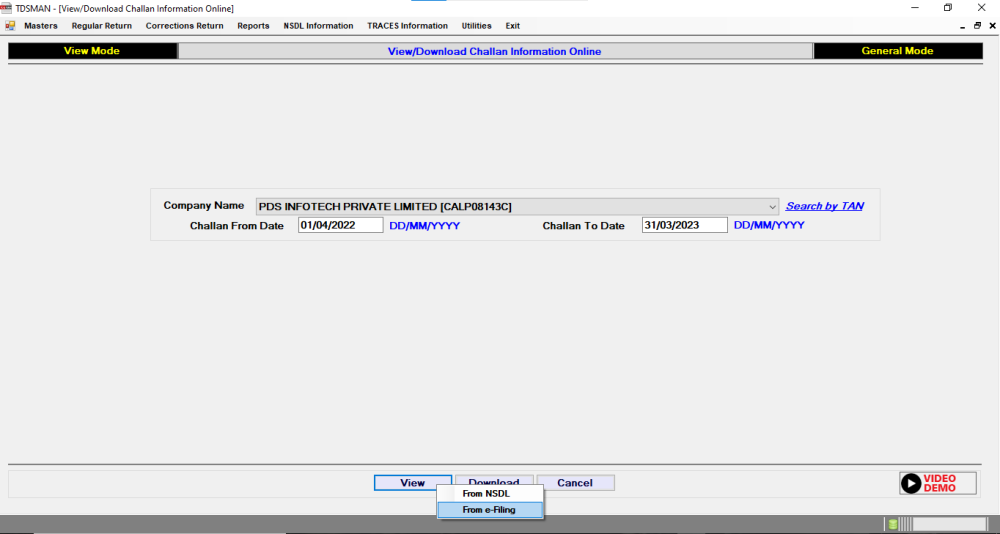

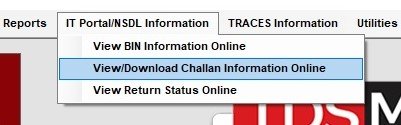

In order to so, click on ‘IT Portal/NSDL Information > View /Download Challan Information Online’

The following screen will get displayed:

Company Name: Select the Company Name

Challan From Date: Enter ‘Challan From Date’

Challan To Date: Enter ‘Challan To Date’

Click on ‘View’. Challan can be viewed ‘From e-Filing’. Select and proceed accordingly.

Note – Old Challans can be viewed ‘From NSDL’

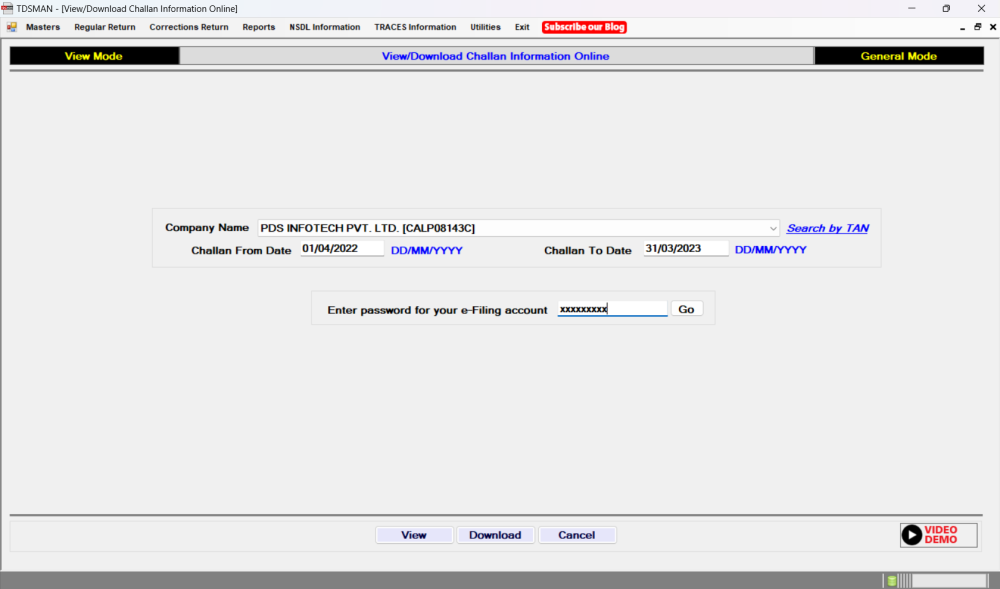

Enter the ‘Password for e-Filing Account’ and click on ‘Go’ (Password is auto filled if saved in the software previously). This will take the user to Income Tax Portal which is outside of TDSMAN Software.

Enter the User ID & Password to login. After logging in successfully, click on ‘e-Pay Tax’ under ‘e-File’ option.

Select ‘Payment History’ for viewing the Challan details.

Select ‘Challan Status Online’ & click on ‘Download Challan File’ to download the Challans.

Close this screen to get back to the TDSMAN Software.

Need more help with this?

TDSMAN - Support