This module provides a summary of the computed tax under both, the Old and New Regime. It is done on the basis of the tax computation data for each employee as provided in the Annexure II of Form 24Q – Quarter 4.

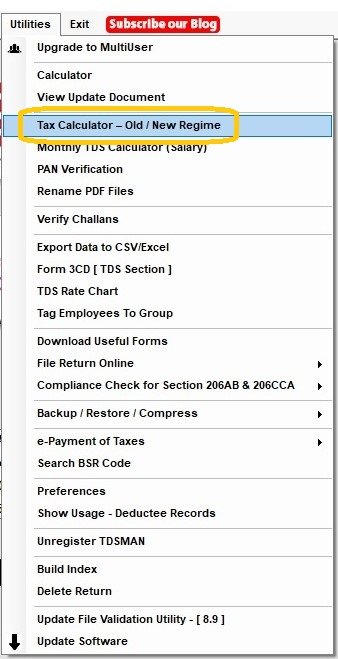

This will help in determining the regime that is beneficial for the employee. In order to do so click on Utilities > Tax Calculator – Old/ New Regime, as shown below :-

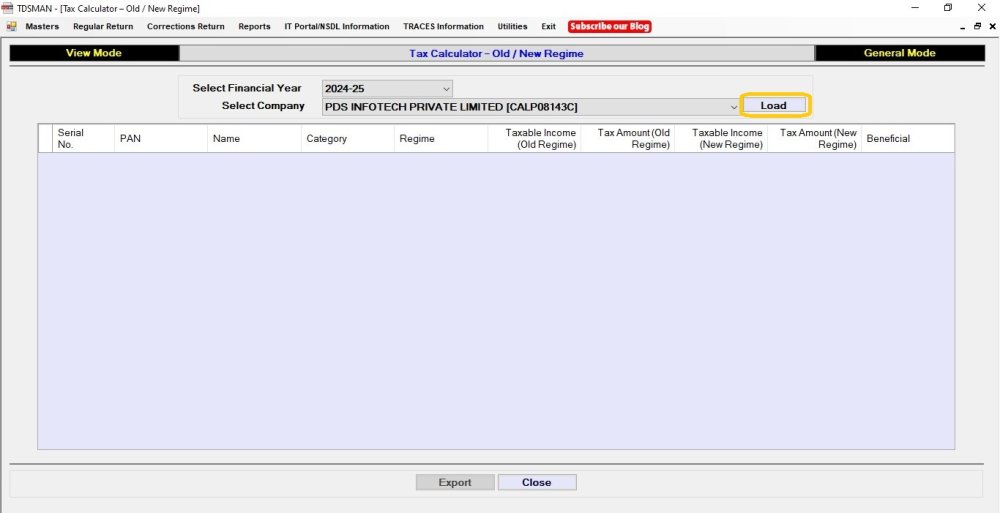

The following screen will get displayed :-

Select ‘Financial Year’ – Select the FA year for which the tax needs to be calculated.

Select ‘Company’ – Select the company, for which the tax needs to be calculated.

Click on ‘Load’ .

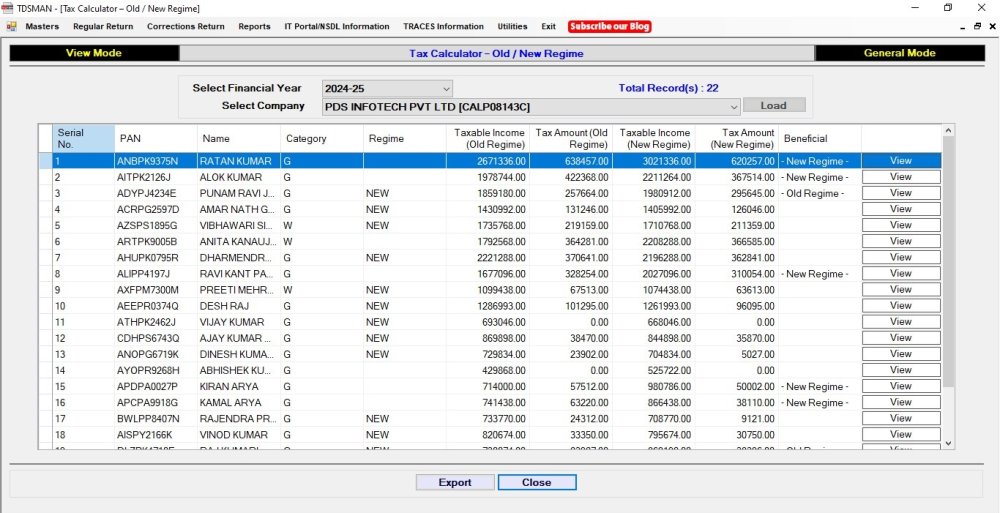

The system will fetch the tax computation data for each employee as provided in the Annexure II of Form 24Q – Quarter 4. It will calculate and display the Tax amount in the Old and New Regime as shown below :

The above report displays the following: -

Serial No. – The running serial number of records fetched

PAN – The PAN of each Employee

Name – Name of the employee

Category – Indicates whether the employee is in General Category or Women or any other specific category.

Regime – Indicates whether the employee is in Old regime or New Regime. Blank indicates Old regime

Taxable Income (Old regime) – The Taxable income calculated under the Old regime

Tax Amount (Old regime) – The Tax liability calculated under Old regime

Taxable Income (New regime) – The Taxable income calculated under the New regime

Tax Amount (New regime) – The Tax liability calculated under New regime

Beneficial – On the basis of the data provided and calculated, the system determines if the regime selected is beneficial for the employee. In case it is not beneficial, the system will indicate the same.

Export – In order to export this data in Excel, click here.

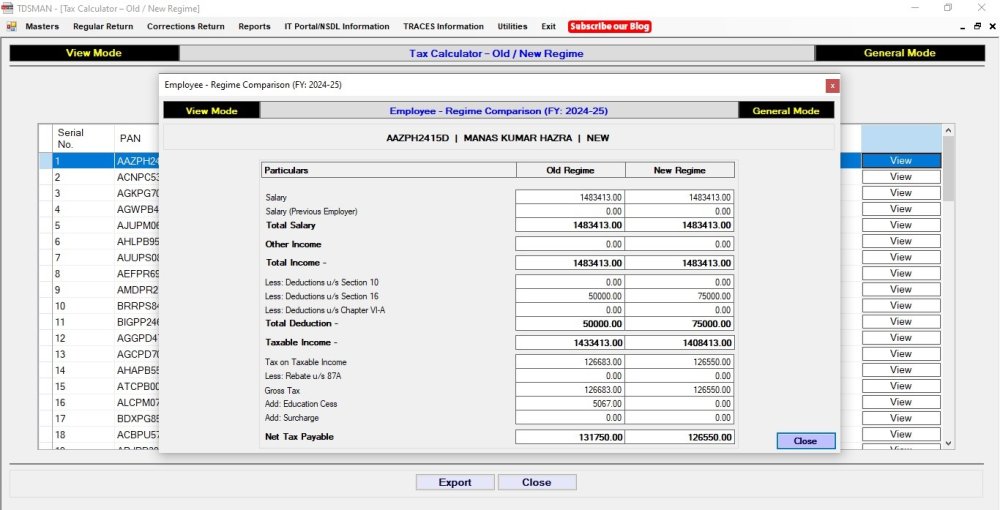

View – In order to see the detailed break-up of the tax calculation of each employee, click on ‘View’, the following screen will get displayed :

Need more help with this?

TDSMAN - Support