It is mandatory for the ‘Employer’ to provide details of tax computation of each employee and the total tax deducted (TDS) during the financial year. This information is to be entered in the 4th Quarter of Form 24Q in Annexure II.

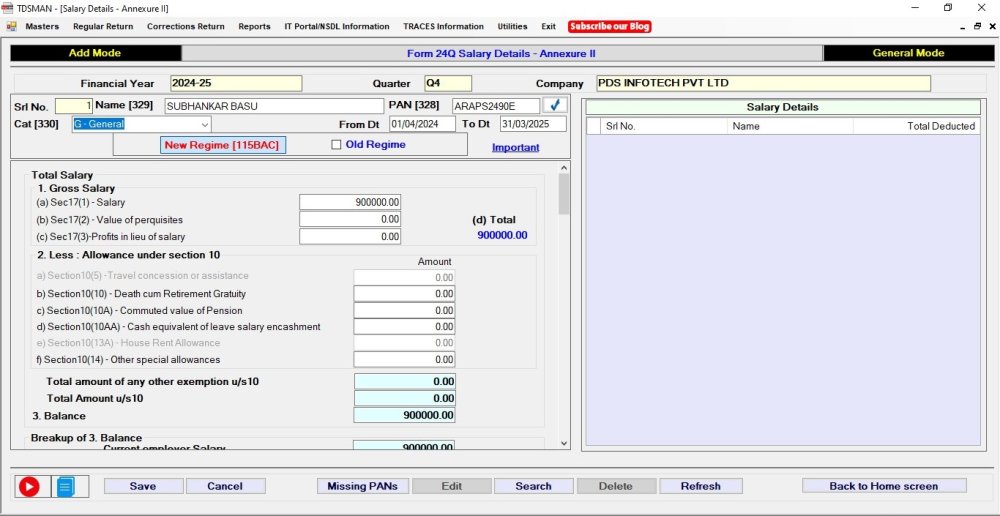

In Form 24Q – Q4, click of the ‘Salary detail (Annexure II)’ button on the Home Screen. The following interface is displayed:

Through this, tax computation of each employee is entered. Please note, it is a long form and needs to scrolled. Towards the end of the form, the total tax deducted (TDS) during the financial year also needs to be entered.

There are three sections in the interface:

- Left Panel – Data of each employee to be recorded here

- Right Panel – Recorded data is listed here in the sequence of entry

- Bottom – it has the self-labelled action button

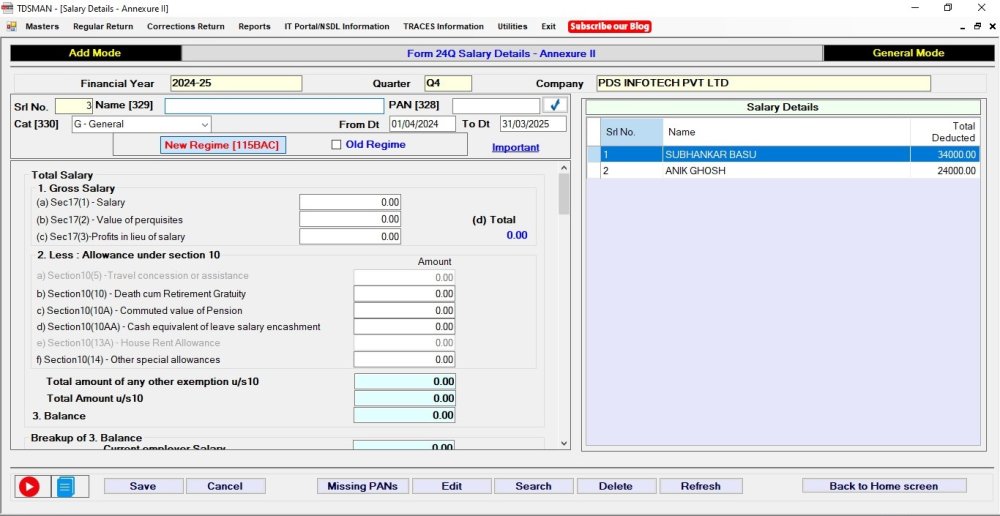

After providing the details of employee, click on ‘Save’. The saved record is displayed on the right panel. Keep entering for rest of the employees in a similar manner. This is a long form which needs to be scrolled down. An illustrative screen is displayed below:

Note: The content of the data is similar to the format and sequence as in Form 16

Important points to take note:

Employee List Help:

While entering the ‘Employee Name’, a help screen with the list of employees with the matching text is displayed for selection. If a new ‘Employee’ is entered (i.e. not appearing in the display list), it will accept and a new record will be created in the list which will appear for the future.

New Tax / Old Tax Regime:

The tax computation is based on the ‘New Regime’ or the ‘Old Regime’. From FY:23-24, the default Regime would be ‘New’. The employee may opt for the ‘Old’ regime.

Tax Calculation Help:

The system will display the taxable income and the computed tax based on the selected Regime alongside where the data is being entered for each employee. This is useful to ensure the data provided is in compliance. One may view the system calculation by clicking on ‘View Calculation’

Total TDS Deducted Help:

Tax is deducted from employees throughout the year. The amount as entered should be as per the data provided during the course of the quarters during the year. The sum of TDS for the employees are (information taken from Regular Returns only that is prepared from TDSMAN) is shown alongside with a Help option to view the details of TDS month-wise.

Missing PAN:

The button on the Bottom Panel is for getting a list of all PANs (Employees) wherein it has data during the course of the financial year, but it is missing in the Annexure II. This may be helpful to address situations in case it has been inadvertently missed out.

Modify a Salary Record:

In order to modify information on an ‘Employee’ record, select the record that needs to be modified from the Right Panel and either double-click or click on the “Edit’ button. The selected record will be displayed on the Left Panel which can now be modified and ‘Saved’ again.

Delete a Salary Record:

In order to delete an ‘Employee’ record, select the record that needs to be deleted from the Right Panel and click on the ‘Delete’ button. The record will be deleted after seeking reconfirmation.

Need more help with this?

TDSMAN - Support