In Form 24Q (Salary Returns), TDS is reported for each employee in every Return with the monthly breakup. In the 4th Quarter, additionally, in Annexure II, the annual tax computation for each employee needs to be provided.

It is expected that the Salary and TDS reported each month should match with the information as provided in Annexure II. This is important to avoid defaults.

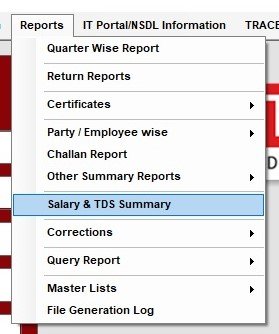

Click on ‘Reports > Salary & TDS Summary’. The following screen will get displayed:

Select the Company and FA Year.

One needs to also specify the basis of the Salary amount. It may be the sum total of the values as provided in Section 17(i) to 17(iii) or after subtracting the admissible deductions under Section 10.

Based on this selection, the Salary amount will be displayed in the report. After selecting the specified option, click on ‘Ok’

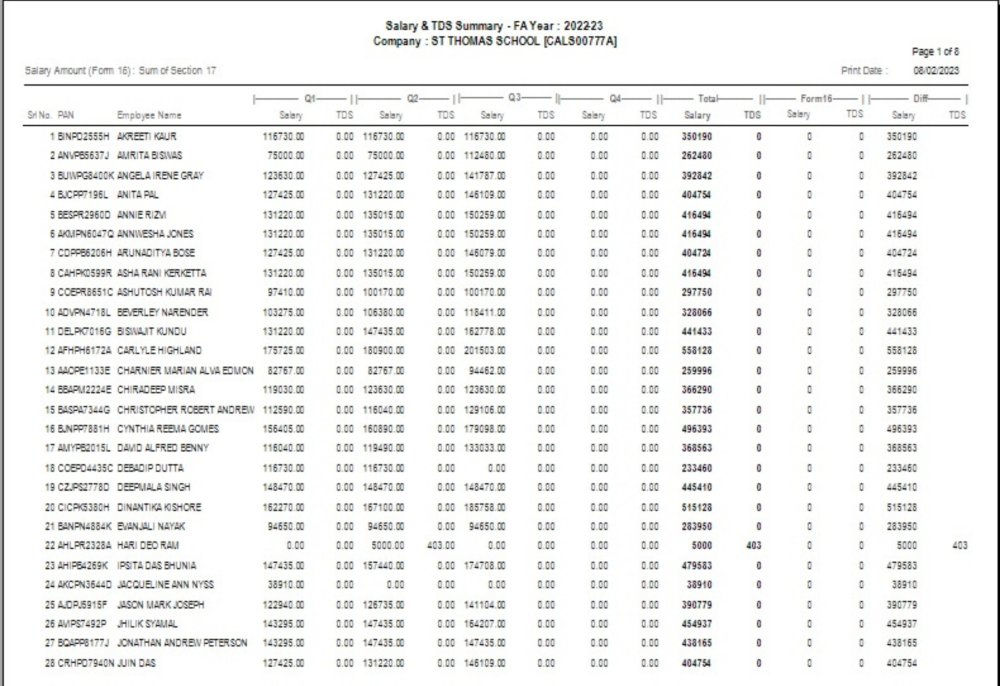

The report will get generated as under:

In the report, for each employee the quarterly break up with the totals, along with Annexure II (Form 16) values have the provided. In case of difference in the two values, it is also displayed.

Need more help with this?

TDSMAN - Support