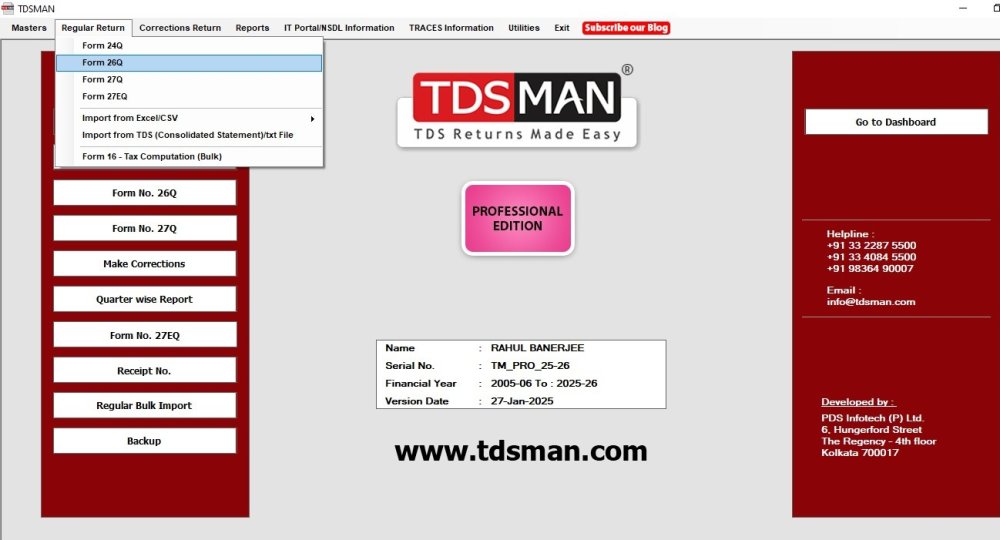

This module is for calculating defaults for regular and correction return if any. In order to do this, click on the relevant Form No. for selecting the Return to check for possible defaults.

The following screen will get displayed:

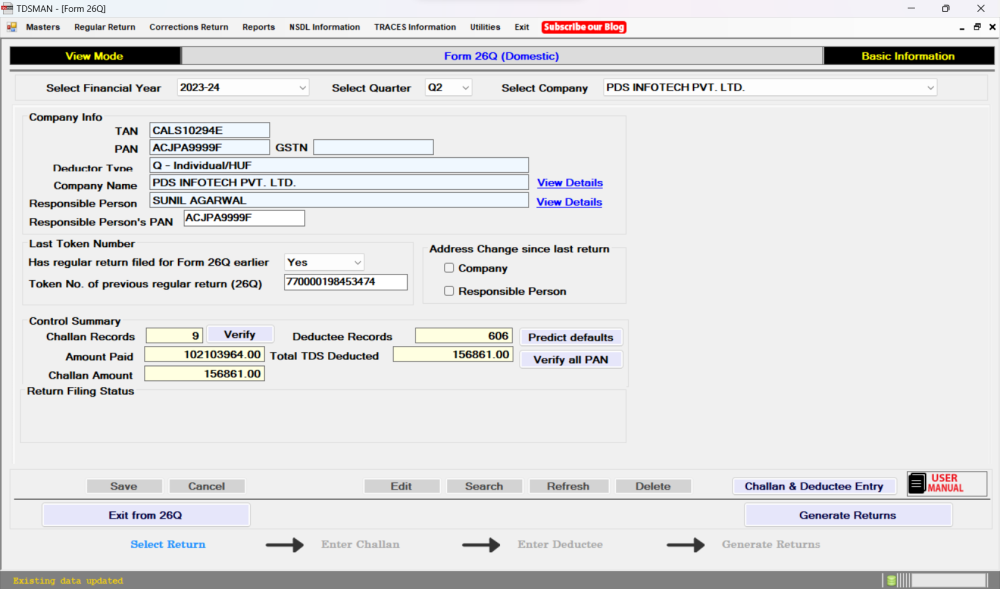

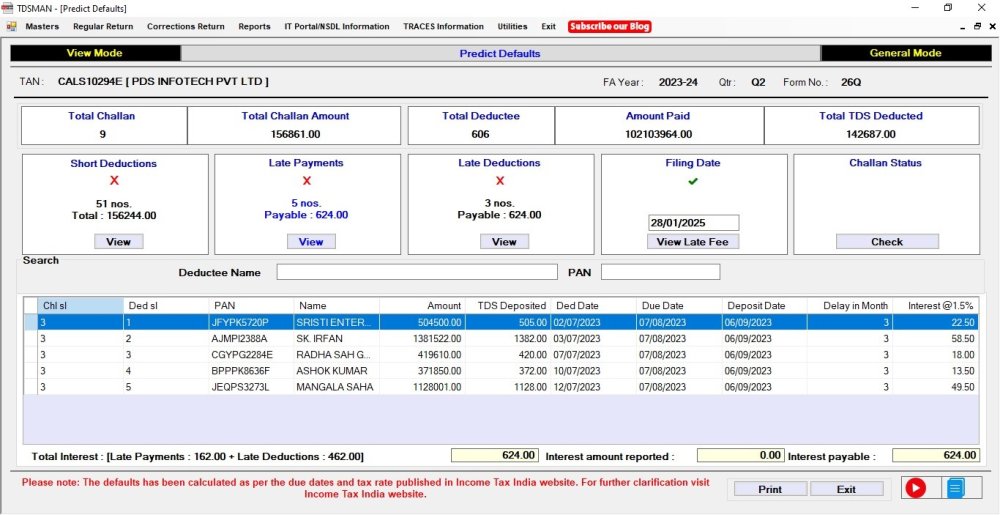

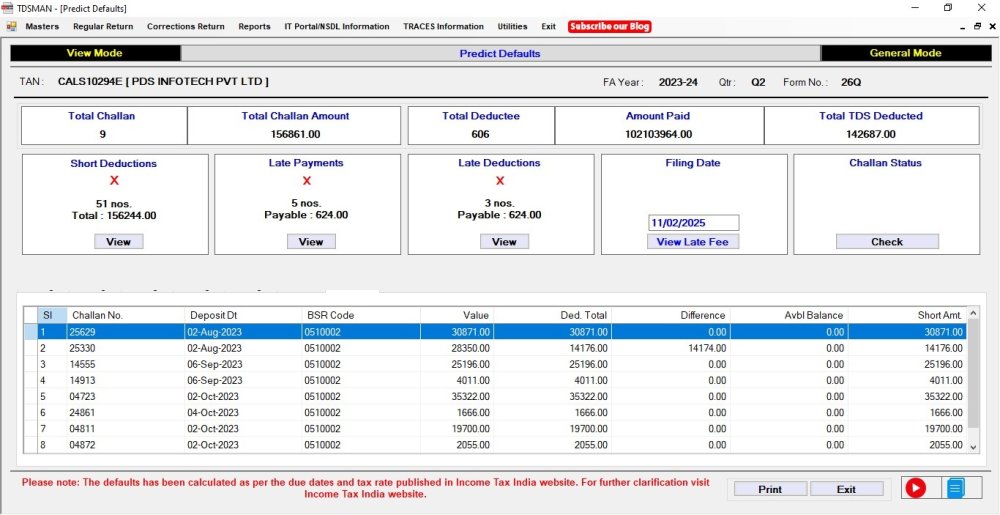

Select the Return for which the Default needs to be checked (Select the ‘Financial Year’, ‘Quarter’ and ‘Company’). Click on ‘Predict Defaults’ & the following screen will appear:

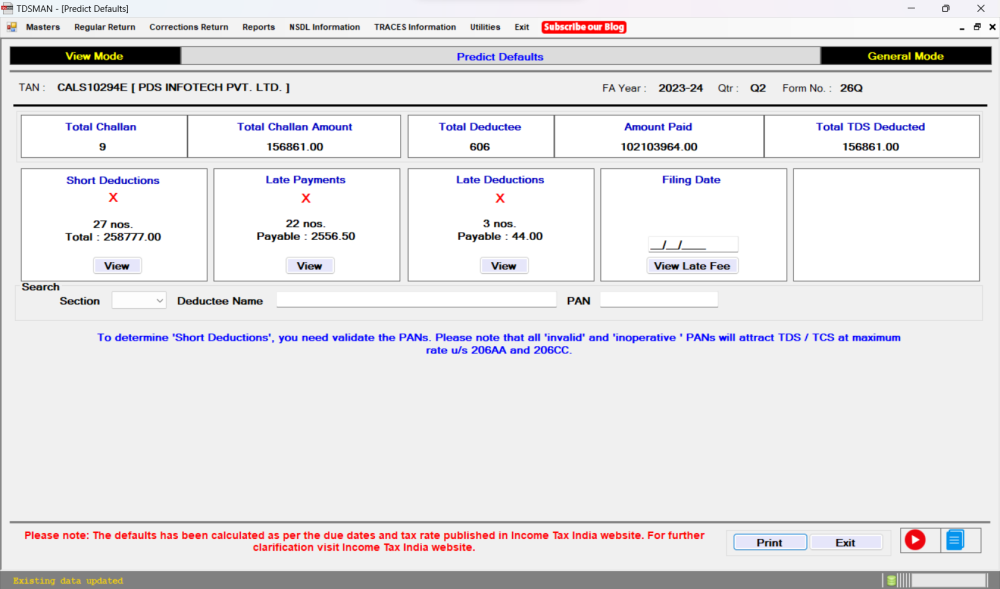

It will find out Short Deduction, Late Payments, Late Deductions if any. It will also calculate Late Fee for filing the return.

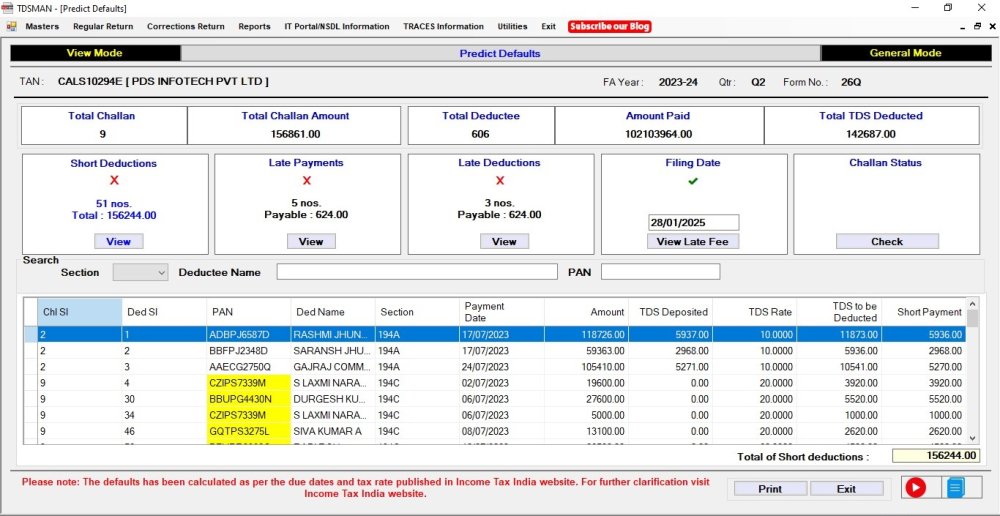

Short Deduction: In case any value is found under ‘Short Deduction’ click on ‘View’ for the details displayed as under:

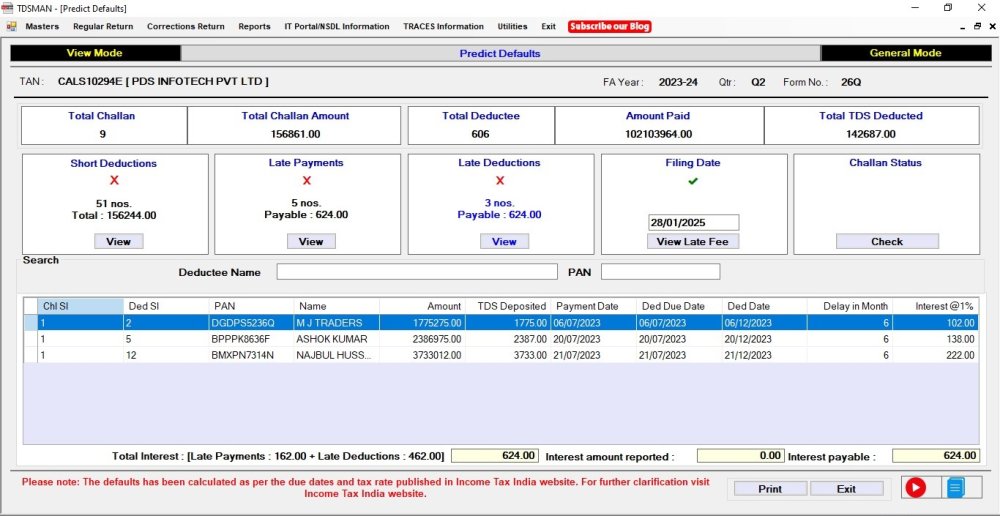

Late Payment: In case any value is found under ‘Late Payment’ click on ‘View’ for the details displayed as under:

Late Deduction: In case any value is found under ‘Late Deduction’ click on ‘View’ for the details displayed as under:

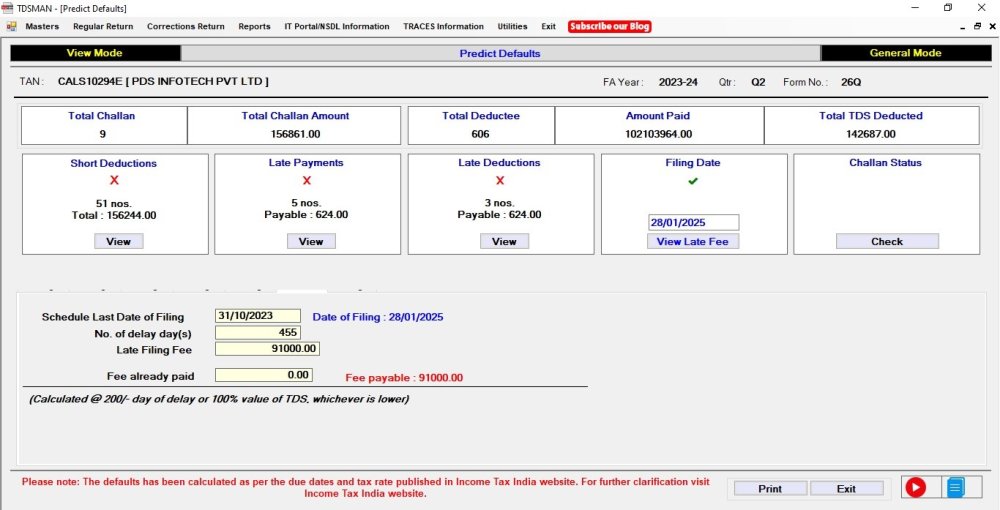

Late Filing Fee: In case, the return has not ben filed ‘On Time’, one needs to check the ‘Late Filing Fee’ that needs to be paid based on the date on which it would be filed. To do so, enter the Current Date & click on ‘View’. The payable fee will get displayed as under:

One needs to enter the filing date based on which the ‘Late Filing Fee’ would be calculated and displayed.

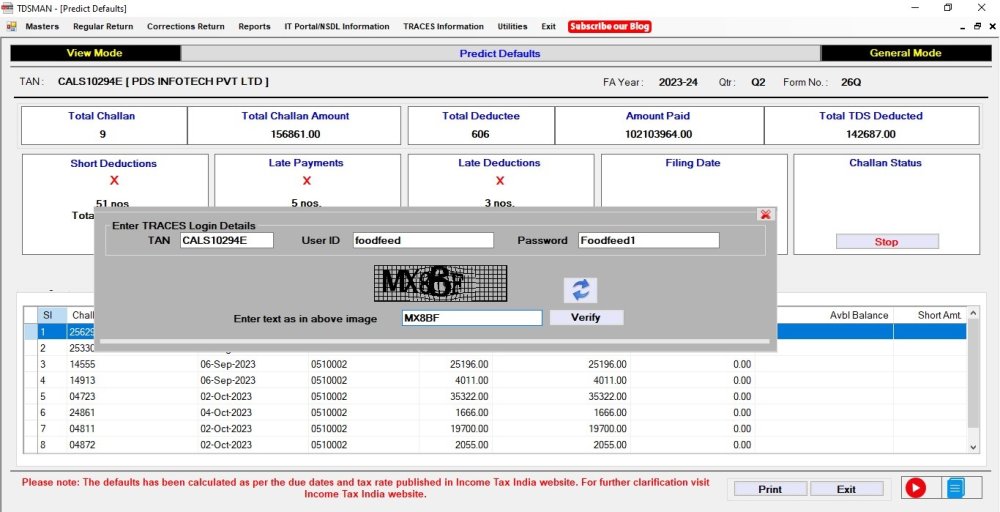

Challan Status :

Challan Status, provides the current available balance of all the entered challans. In order to do so click on ‘Check’ in the Challan Status box. Once the credentials of TRACES are validated, click on ‘Verify’ .

The process commences and the current available balance of the extracted challans can be viewed in the interface below:

Need more help with this?

TDSMAN - Support