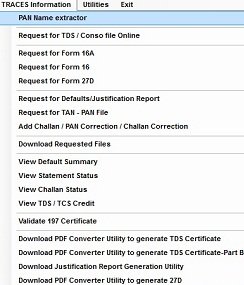

This module provides the option to verify PANs by extracting the name linked as per the records with the Income Tax Dept. Further, it also checks for the ‘Inoperative’ status. In order to proceed, click on ‘TRACES Information’ > ‘PAN Name Extractor’

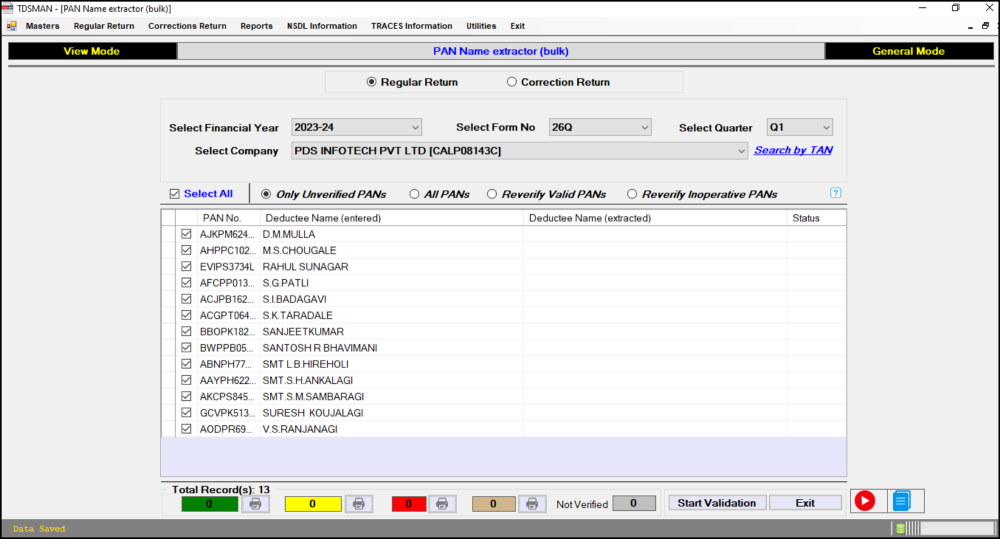

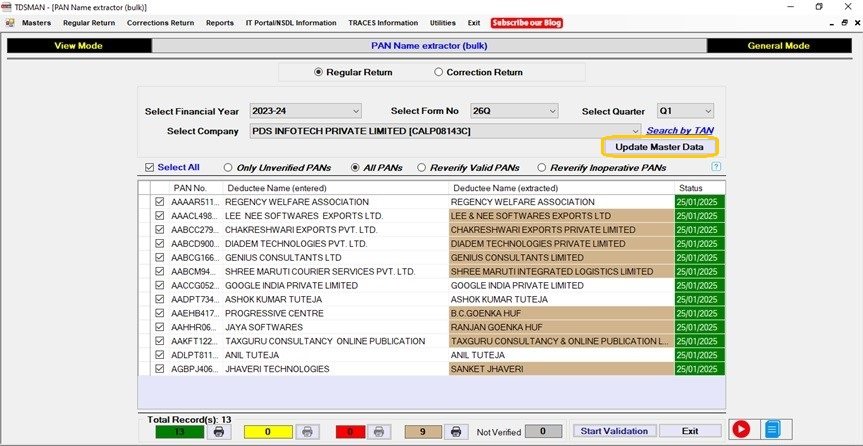

Following screen will get displayed:

This module can be used for both Regular and Correction Returns. Select Company, Financial Year, Quarter and Form Number.

The list of PANs within the selected Return that has yet not been verified earlier (Only Unverified PANs) will be displayed by default. One may select either ‘All PANS’ or ‘Reverify Valid PANs’ or ‘Reverify Inoperative PANs’ as the case may be and accordingly the list will be displayed.

In the list, only the PANs that has been selected / checked will be verified. All PANs can be selected by checking on ‘Select All’ or unselect all by unchecking on ‘Select All’. Additionally, PANs in the list can be checked / unchecked individually.

To initiate the validation processes, click on ‘Start Validation’ button. Enter the TRACES details: i.e. TAN, Username, and Password. If credentials have been saved previously, they will automatically populate. Finally, enter the Captcha Code & click on ‘Go’.

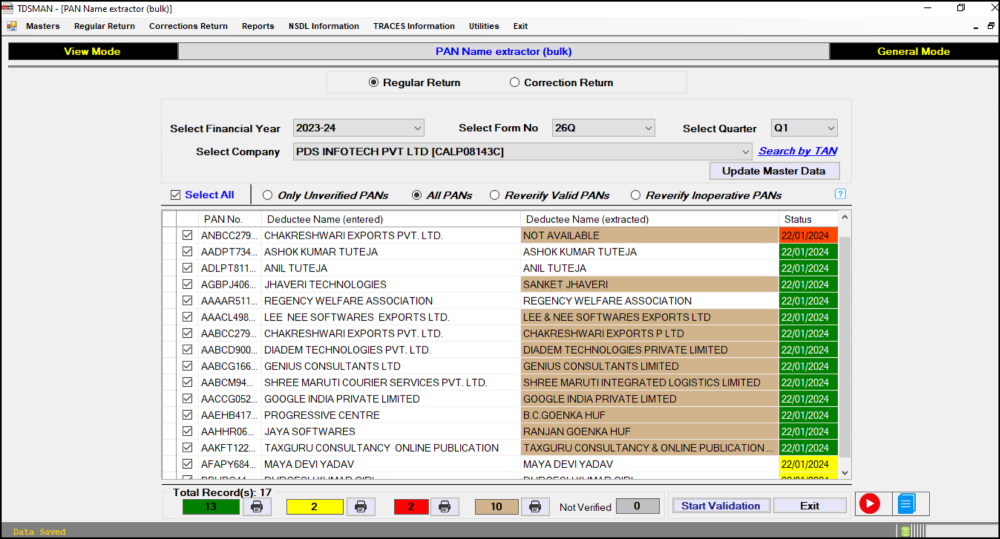

Once the credentials of TRACES is validated, the process commences and the progress of verification and name extraction can be viewed interface below:

The status bar at the bottom displays the summary in numbers. If the status is GREEN, the PAN is valid, if RED, the PAN is invalid, if YELLOW, the PAN is Inoperative.

A BROWN status for the entered Deductee Name indicates a Name Mismatch as per the software and the extracted name. As long as the PAN is proper and correct, the ‘Name Mismatch’ is insignificant.

If verification for a PAN cannot be completed for any reason, the status will be in GREY.

On the ‘Status’ column, the Date of this ‘Verification’ is recorded / updated for each PAN. This ‘Date’ is maintained in the software as the last date of verification individually for each PAN.

Update Master Data :

For all the PANs in brown, which indicates name mismatch, the name in the software can be replaced and updated with name recorded in the income tax department by clicking on it.

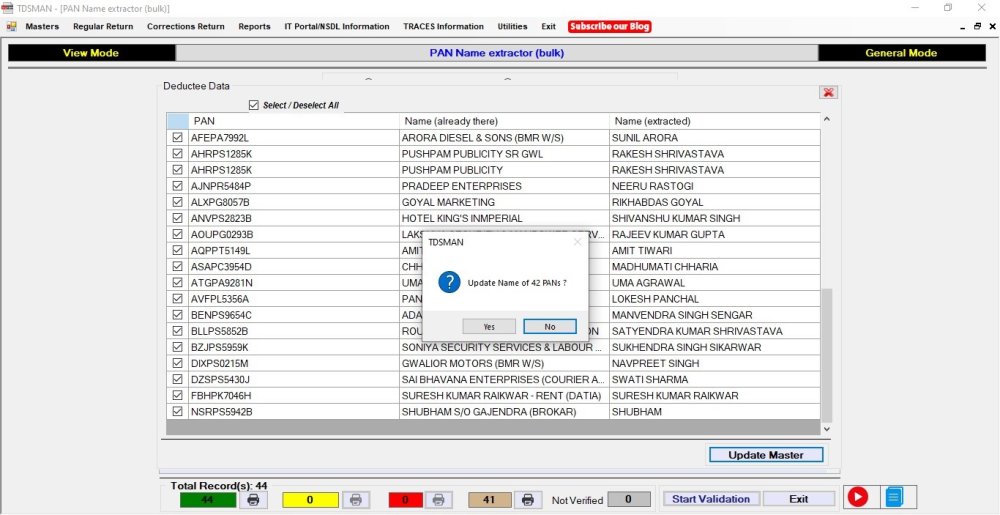

Click on ‘Update Master Data’, the following screen will be displayed:

The records with corrected names is displayed. The user can select each record individually or all the records can be selected together and click on ‘Update Master’.

All the names which were earlier in brown with name mismatch will get corrected as shown below:

Click on ‘Yes’

Need more help with this?

TDSMAN - Support