The filing of TDS / TCS Returns can be filed online through the Income Tax Portal. We have integrated the IT Portal screens directly from the software. Go to ‘Utilities > File Return Online’

The ‘Upload TDS’ is for filing of the Return. ‘View TDS’ is for retrieving filing details of earlier Returns.

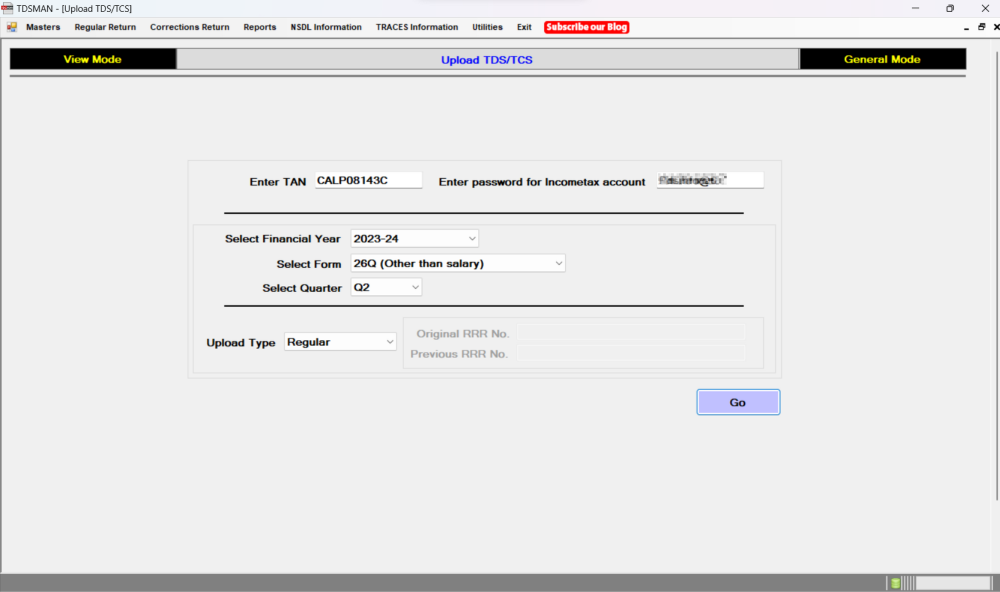

Upload TDS

Select ‘Upload TDS’ and the following screen will get displayed:

Enter the TAN & the Password for Income Tax Account’. Select the ‘Financial year’, ‘Form’, ‘Quarter’ & ‘Upload Type’ (Regular / Correction) and click on ‘Go’.

This will open the browser and take you to the page on the Income Tax Portal from where the TDS / TCS Returns are filed. The process to file in the IT Portal is summarized as under:

- Select the option ‘Deduction of Tax at Source (From TDS)’ and click on ‘File Now’

- The next screen titled ‘TDS/TCS Return’, click on “Let’s Get Started”

- In the following interface, provide the information for the Return to be filed and click on ‘Proceed with e-Verify’

- In the following interface, there are multiple verification options. Select the appropriate one and complete the filing process.

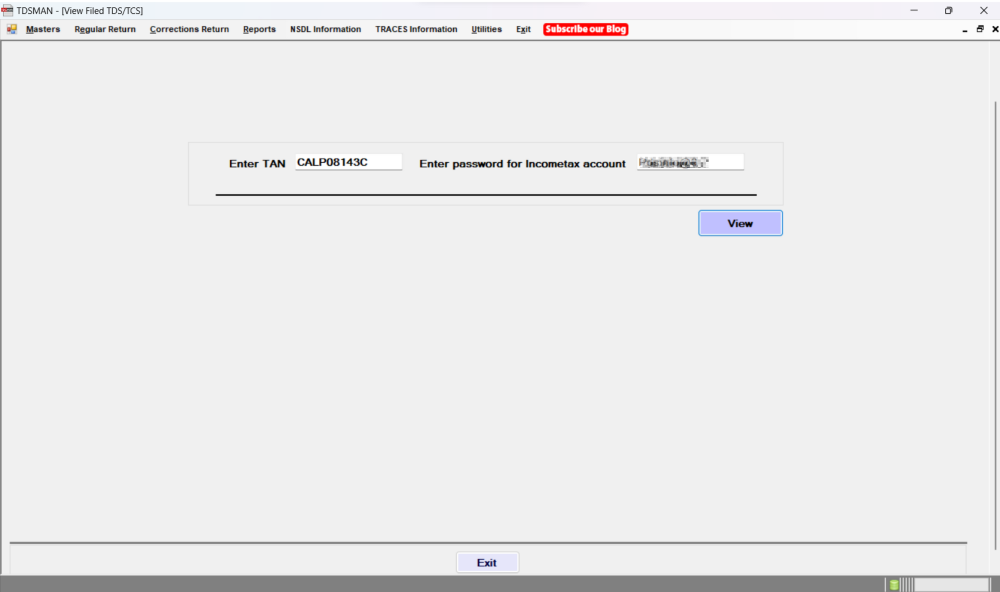

Retrieve Filing Details

To retrieve the filing details of earlier Returns, Select ‘View TDS’. The following screen will get displayed:

Enter the TAN & the ‘Password for Income Tax Account’ and click on ‘View’

This will open the browser and take you to the page on the Income Tax Portal, where the filing details of the selected Return can be retrieved.

Need more help with this?

TDSMAN - Support