In case there is no information for a particular TDS / TCS Return that needs to be filed, one option is to file a NIL Return. The other and better option is to declare this on TRACES web portal. This may be done through TDSMAN.

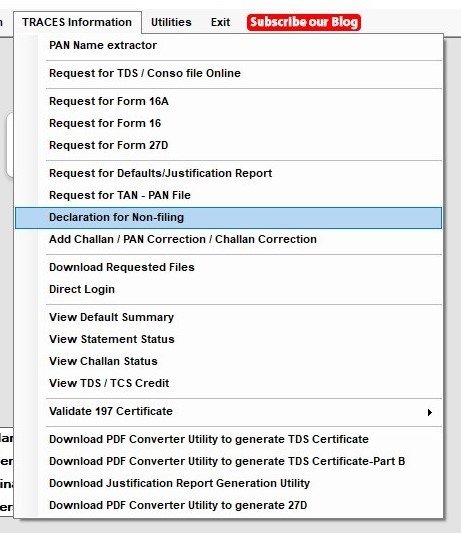

Click on ‘TRACES Information > Declaration for Non-filing’

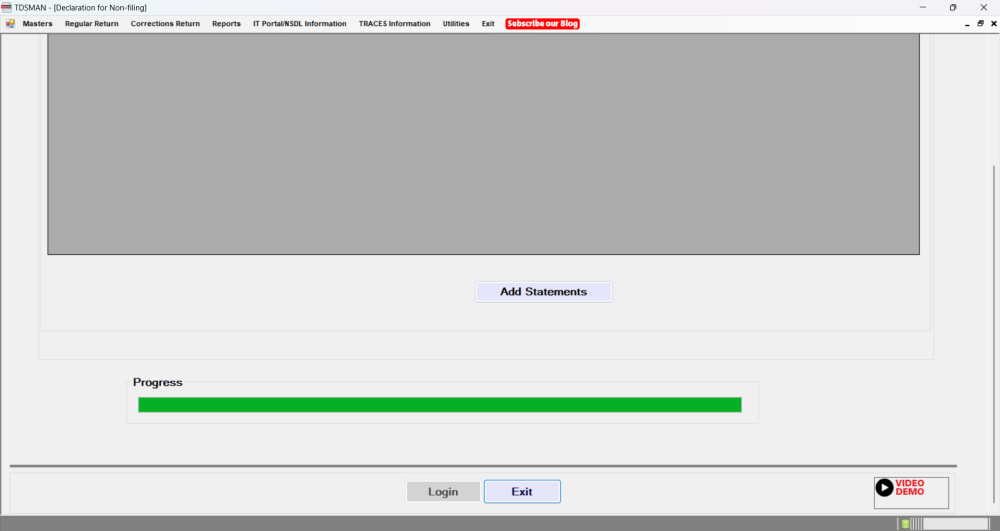

In the next step, login to TRACES. After successful login, following is displayed:

The grid will show earlier declarations made if any. This is just for information purpose. To add a new ‘Declaration’, click on ‘Add Statements’ which will open the following interface:

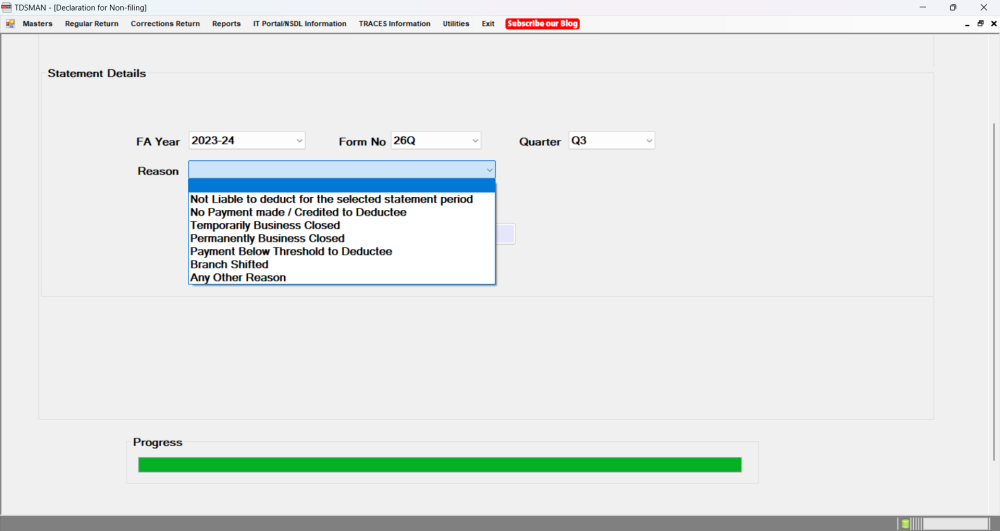

Select the TDS / TCS Return (FA Year, Form No. & Quarter), ‘Reason’ and click on ‘Go’. Once it is successful, confirmation message will be displayed.

Need more help with this?

TDSMAN - Support